Retirement Planning Process

Finding the right mix of growth, protection and income.

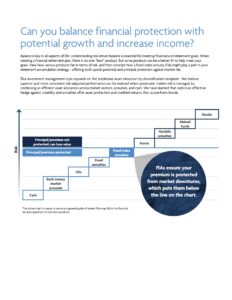

Our process of continuous planning and asset management includes an analysis of price trends, intramarket dynamics (examining the relationship between 11 different sectors), and several forms of bonds, including corporate, municipal and yield curve U.S. Treasury. Cash flow and income analysis supports the asset allocation process. Our analysis includes the use of our proprietary AnnuiNote process, a process we use for financial analysis that includes combinations of annuities and structured notes. This process integrates with our strategic financial advisory services and is weighted against the specific investment objectives and constraints outlined within the investment policy statement of a client to arrive at a suitable allocation strategy. We then perform this analysis quarterly and rebalance portfolios accordingly.

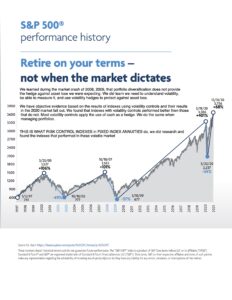

We believe that economic cycles exist, and economic sectors expand comparatively at various rates of change over time. The result of this is that price for various market sectors changes in relation to each other and are different depending on where we are in the economic cycle.

Risk cannot be eliminated. It is inherent to the investment process. Without risk there would be no returns. To manage risk and achieve investment success requires adherence to the principle of portfolio diversification and combining it with risk controls. Cash is a risk control tool.

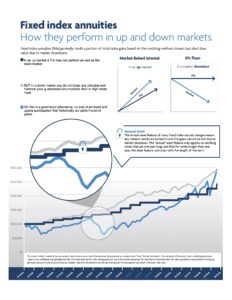

Incorporating guaranteed income streams into an overall retirement investment plan reduces the need for an investment portfolio to perform 100% of the time. Income from Social Security, pensions, and guaranteed lifetime income streams from insurance products and annuities create the foundation to pay for your core needs and wants and protects you from needing to use discounted assets from your investment portfolio to fill these lifestyle commitments. Guarantees and protections provided by insurance products are backed by the financial strength and claims-paying ability of the issuing carrier.

We believe annuities have a place in every retirement portfolio, the question is which type and how much should be allocated.